In Commodity News 01/07/2017

As the first half of the year draws to a close, disappointment in the slumping commodities sector grows.

After posting a gain last year for the first time in six years, the Bloomberg Commodity Index BCOM, +0.34% which tracks 22 commodity futures contracts, is down roughly 7.7% year-to-date to stand below the $81 level Wednesday. It finished out 2016 more than 11% higher.

The index “tried to show some life in 2016 only to crap out in 2017 thus far,” said Adam Koos, president of Libertas Wealth Management Group.

“The lows around $82 were an important level of support that had been touched four times in a year,” he said. “Thanks to weak oil prices, that same floor gave way and broke this June.”

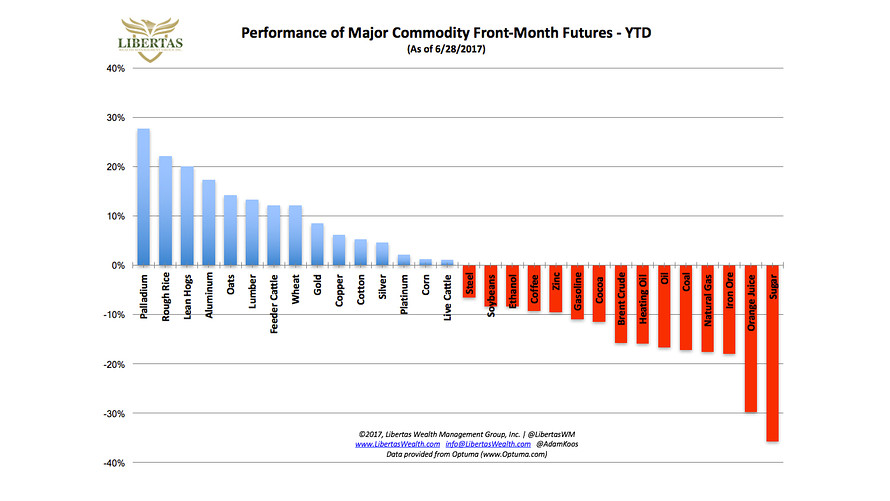

Many commodities have continued on the downward paths they were on by the end of the first quarter, with sugar SBV7, +1.63% down about 36% for the year as of Wednesday, iron ore trading 18% lower, and oil CLQ7, +0.69% LCOU7, +0.55% suffering a loss of roughly 16%.

Palladium PAU7, -1.09% meanwhile, held ground as one of the biggest gainers, up about 28% year to date.

Gold GCQ7, -0.18% has also extended it’s climb for the year so far, trading up 8.5%, even after two U.S. interest-rate hikes by the Federal Reserve in 2017. Still, the moderate price climb means that gold no longer ranks among the top 10 best performing major commodities as it did in the year to date through March.

Other gainers included lean hogs LHQ7, +1.86% up 20%, lumber LBU7, +2.92% up 13% and rough rice RRU7, +0.50% which has climbed 22% year to date. Frozen concentrated orange juice OJU7, -0.04% down 29%, natural gas NGQ17, -0.46% with a loss of 16%, and heating oil HOQ7, +0.48% down nearly 17%, were among the commodities posting steep declines.

Here’s a rundown of the influences and outlook for the biggest commodity movers:

Sugar

For the month of May, sugar saw the biggest decline—about 7.8%—among major commodities, and it’s lost close to 9% in June as the industry saw higher production from favorable weather.

The chart above from the U.S. Department of Agriculture shows the leap in global sugar production for the 2017/2018 crop year.

Back in May, Jodie Gunzberg, managing director of product management at S&P Dow Jones Indices, said traders were concerned about an inventory buildup in Mexico from a lack of exports to the U.S.

U.S. President Donald Trump said Thursday that he has negotiated a new sugar trade deal with Mexico this week.

“While the deal may help [U.S.] producers going forward, it’ll likely produce higher prices for the commodity on the futures exchanges,” said Libertas Wealth Management’s Koos. “Considering sugar was the single, worst performer thus far in 2017, any signs of life as a result of this trade deal could lend a helping hand to price as a good mean reversion trade at the very least.

Iron ore

Prices for iron-ore delivered to China recently fell to their lowest level of the year so far, as higher prices at the end of 2016 fueled greater production of Chinese domestic iron ore, said Hector Forster, senior analyst at S&P Global Platts.

Platts’ IODEX prices for 62% iron-ore fines delivered to China marked a year-to-date low of $54 per dry metric ton on June 13, according to S&P Global Platts, but recouped some of those losses to trade at $63 on Wednesday.

“China’s mining recovery increased iron-ore concentrate and pellet production,” and at the same time, reduced demand for imports,” said Forster.

Still, recent strength in steel prices in China, along with “firmer indicative mill margins, [are] keeping up demand for iron ore,” so a recovery in prices has been solidifying in the past few weeks, he said.

“Price volatility for iron ore remains a concern, owing to the potential for [a] drawn down of port stockpiles at high levels, particularly so during lower steel capacity utilization and at [a] time of lower margins,” Forster said.

Oil

The oil market has basically stuck to main themes so far in 2017: OPEC disappointment and a “relentless” rise in U.S. production, said Tyler Richey, co-editor of the Sevens Report.

Both of those have been bearish for energy prices, he said, with WTI hitting its lowest level of the year just last week at under $43 a barrel.

Disappointment over the output cuts led by the Organization of the Petroleum Exporting Countries in the first half of the year was “not due to lack of compliance as many analysts had feared, but rather because their policies did not influence stockpiles as they had hoped, and global supply levels h ave remained near records,” said Richey.

On Thursday, Société Générale sharply cut forecasts for Brent and WTI oil prices for this year and next, citing rising supplies from U.S., which is not a member of OPEC, as well as growing output from Libya and Nigeria—OPEC members that aren’t required to cut production.

Still, some analysts believe that U.S. output from shale, in particular, is set to decline.

“As we enter the second half of the year, market focus will remain on the trend in U.S. output because OPEC policy can be considered a constant in the fundamental equation, as further cuts by the cartel are rather unlikely,” Richey said.

Palladium

The path for palladium prices was clear early on in the year, with the metal ending the first quarter up nearly 17% higher.

“There is a supply shortage, which helped start the price of palladium running higher, but the major use of palladium is pollution control in vehicles, so the recent drop in automobile demand should have caused a drop in prices,” said Chris Gaffney, president of EverBank World Markets.

He said palladium’s price climb is “not necessarily warranted and is mainly due to speculators taking long positions”—believing that supply shortages will boost the price of the metal in coming months.

Precious metals continue to be a good investment alternative for diversification purposes, Gaffney said, but both silver SIU7, -0.47% and platinum PLV7, +0.34% “look to me to be better opportunities at current levels.

Gold

Gold prices traded about 8.5% higher year to date as of Wednesday, even as some analysts expected the Federal Reserve’s decision to increase interest rates in March and June to spur a gain in the U.S. dollar, which would in turn weigh in dollar-denominated prices for the precious metal.

“That is a much more moderate rate of increase [for gold] than we saw in 2016 “ said George Milling-Stanley, head of gold investment strategy at State Street Global Advisors.

“By the second quarter of last year, gold was trading 30% above the lows reached in December 2015—the time of “the first rate increase in the current round of normalization of interest rates,” he said. But that rise for gold “ultimately proved unsustainable.”

Gold’s “moderate” pace of growth so far in 2017 “certainty feels much more sustainable,” Milling-Stanley said.

So far in the current cycle, gold has found support in periods of weakness at “successively higher levels”—around $1,050 in December 2015, $1,125 in December 2016, a fraction under $1,200 in march 2017 and $1,275 ahead of the hike in June this year,” he said, pointing out that the fact that the level of support has been $75 higher each time is probably coincidental.

Still “any market that experiences a series of higher lows is interesting because that often leads to a sequence of higher highs,” Milling-Stanley said. Gold could “now move higher to test overhead resistance that has been in place since early 2013 in the area above $1,350.”

A rise above “overhead resistance” could come as soon as later this year, or sometime in 2018,” he said.

Source: MarketWatch